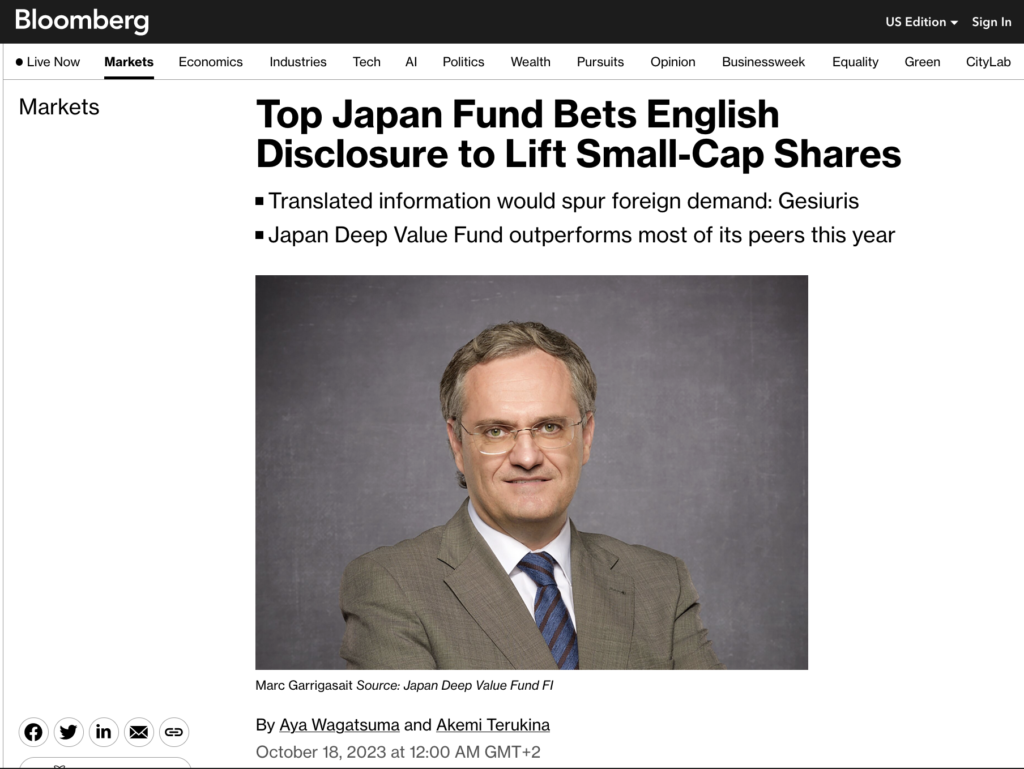

“An article from Bloomberg Japan, translated into English by a Japanese analyst from the Japan Deep Value Fund team. Also you can view the English article here.”

Overseas Money Accelerating Investment in Japanese Small-Cap Stocks with English Disclosure, says Spanish Fund

Japan’s top-performing fund managers in small and micro-cap stock investments anticipate an acceleration in inflow of overseas investments due to expanded English-language information disclosure. They are confident in further portfolio expansion, riding on the initiatives of the Japan Exchange Group.

Mark Galigasaito, a fund manager at Spain’s Geshuris Asset Management, foresees an increase in investment capital as the appeal of Japan’s small and micro-cap stocks becomes more widely recognized through English-language disclosures. The Japan Deep Value Fund FI, managed by Galigasaito, has a relatively modest size of around 34 million euros (approximately 5.4 billion yen) but has delivered a year-to-date return of 22%, surpassing the benchmark (TOPIX Euro, including post-tax dividends) by 9%, making it one of the top 3% performers.

JPX Yamamichi, CEO, Attracting Overseas Attention to Japan – Encouraging Investment through IPOs, and More

Recognizing the issue that the reality of Japanese companies is less visible to overseas investors due to language barriers, the Japan Exchange Group emphasizes the importance of information dissemination, including English disclosure. According to an English disclosure survey (as of December 2022), while the top market capitalization stocks in the Tokyo Stock Price Index (TOPIX) 100 have a 100% English disclosure rate, TOPIX Small stands at 85%. Another survey (as of August 2023) reveals that 84% of overseas investors are dissatisfied with English disclosures due to information shortages and time gaps. Enhanced English disclosure is expected to be effective in attracting investment capital.

When Galigasaito initially established the fund, he spent several months researching translated materials from annual reports to discover undervalued companies with no coverage from Japanese securities firms. Reflecting on the moment when he analyzed all the translated reports, he said, “It was the moment I exclaimed, ‘Wow, this is incredible.'” With the progression of English disclosures, he believes more overseas investors will invest in undervalued Japanese stocks, emphasizing a bright outlook for the fund’s performance in the future.

“A Once-in-a-Lifetime Opportunity”

Also teaching at Pompeu Fabra University’s business school, Galigasaito began managing the Japan Deep Value Fund FI in 2016. The catalyst was his amazement at the vibrant economic activity in Japan despite deflation during his visit in the early 2000s. He noticed improvements in Japanese stock prices, profit margins of listed and unlisted companies, and balance sheets beginning in 2012.

Identifying substantial investment opportunities in undervalued Japanese stocks, especially in small and micro-cap stocks, driven by the transformation of Japan’s market and companies, Galigasaito acknowledged that many Japanese investors were pessimistic about investing in Japanese stocks, presumably due to experiences of investment failures during the 20-year bear market.

Galigasaito discovered what he calls a “once-in-a-lifetime opportunity” and established an investment trust in Barcelona, Spain. When he began managing the fund, over 90% of the portfolio holdings had not yet made disclosures. Currently, English disclosures by Japanese companies are expanding, and corporate governance is showing signs of improvement. Galigasaito evaluates approximately 20% of the companies he invests in as having liquid assets exceeding their market capitalization, stating that such companies are “impossible to find anywhere else in the world.”

The portfolio consists primarily of stocks with market capitalization below $300 million (approximately 59.7 billion yen), accounting for 49%, while those with market capitalization below $2 billion (approximately 298.2 billion yen) make up 45%. These stocks are predominantly small and micro-cap, with many following classic business models, focusing on domestic demand. Galigasaito believes that Japan’s long-term growth cycle has just begun and expresses great satisfaction with his investment in a good portfolio in 2016, anticipating even better performance in the coming 10 to 20 years.

Leave a Reply