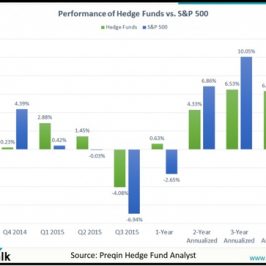

Acaba de anunciarse esta mañana que Societe Generale, el banco parisino acaba de sacar de su armario varios cadáveres de esta reciente crisis. Uno de ellos es unas perdidas brutales de un solo operador de futuros sobre índices de bolsa europea por nada menos que 7,9$ billones.¡¡¡¡¡¡¡ nada menos que 7 veces el agujero de Barings.

LLuis Moncusí, como es costumbre me tiene al corriente con informaciones muy interesantes. Os adjunto lo que me acaba de enviar ahora mismo. Interesantísimo listado histórico con todos los agujeros en derivados producidos en las Entidades financieras mundiales. Están todos, desde Barings, Long Term Capital, Orange County (con el tesorero Mr. Robert Citron, no es broma, a veces los nombres son caprichosos), Drexel, o China Aviation Oil. Veréis año, importes y una mini explicación.

Company Date Detail

Societe Generale 2008 Lost 4.9 billion euros ($7.2

billion) before taxes after

trader went beyond permitted

limits on European stock

index futures

Bank of Montreal 2007 Wrong-way bets on natural gas

led to a pretax loss of about

C$680 million ($663 million)

Amaranth Advisors LLC 2006 Trader Brian Hunter’s bad bets

on natural gas triggered

$6.6 billion of losses

Refco Inc. 2005 Declared bankruptcy after

hiding $430 million of debt

China Aviation Oil 2004 Lost $550 million on

(Singapore) Corp. speculative oil-futures

trades, forcing debt

restructuring

Allied Irish Banks Plc 2002 Trader hid $691 million in

currency market losses

Plains All American 1999 Lost $160 million because of

Pipeline LP unauthorized crude-oil

trading by an employee

Long-Term Capital 1998 Lost $4 billion after a debt

Management default by Russia

Peregrine Investments 1998 Collapsed from at least

Holdings Ltd. $300 million of debt bought

from insolvent companies

National Westminster 1997 Disclosed $125 million charge

Bank Plc to cover options-trading loss

Deutsche Morgan 1996 Fired fund manager Peter Young

Grenfell for unauthorized trading and

paid $279 million to bail out

investors

Sumitomo Corp. 1996 Disclosed a $2.6 billion loss

on unauthorized copper trades

by Yasuo Hamanaka

Daiwa Bank 1995 Disclosed a $1.1 billion loss

from unauthorized trades

Barings Plc 1995 Collapsed after trader Nick

Leeson racked up $1.4 billion

in losses

Orange County, 1994 Lost $1.7 billion from debt

California and derivatives used to expand

its investment fund

Kidder Peabody & Co. 1994 Took a $210 million charge

to reflect what it said were

false bond trading profits by

trader Joseph Jett

Codelco 1994 Trader Juan Pablo Davila lost

more than $200 million

speculating on copper

Metallgesellschaft AG 1993 Lost more than $1.5 billion

trading oil futures contracts

Drexel Burnham 1990 Filed for bankruptcy after

Lambert Inc. pleading guilty to charges of

insider trading and stock

manipulation

Merrill Lynch & Co. 1987 Mortgage trader accused of

racking up $377 million loss

in unauthorized trades

Leave a Reply